Chime – Mobile Banking

About Chime – Mobile Banking

Overview

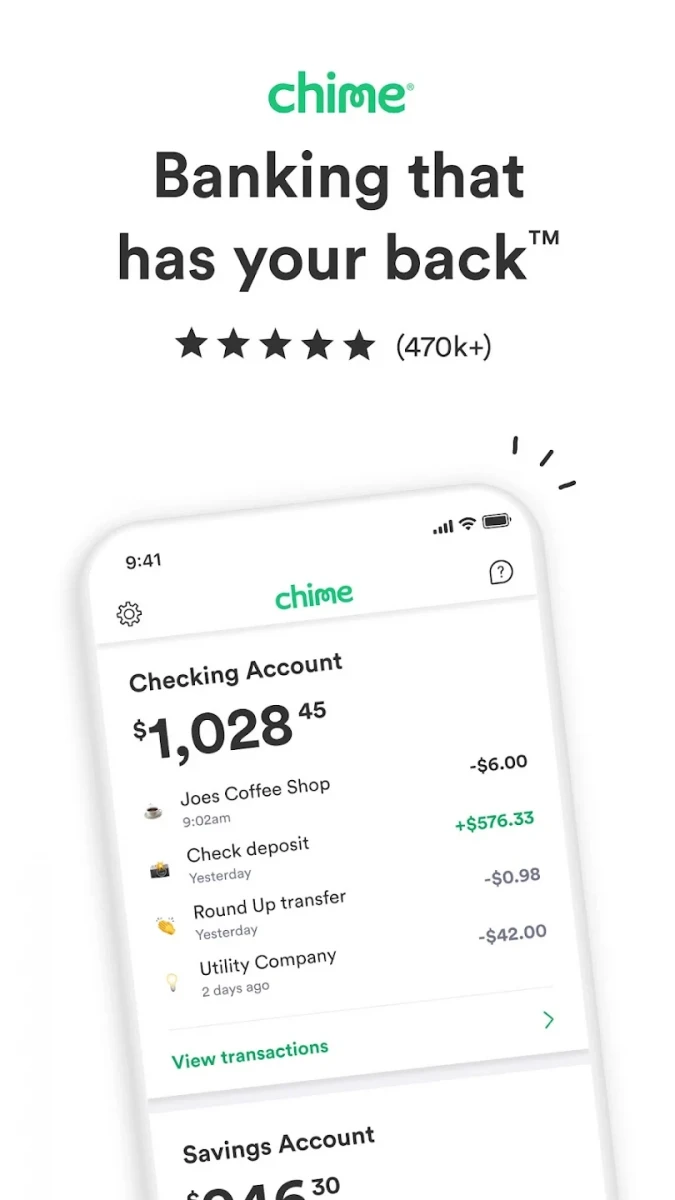

Chime is a banking app that provides financial technology services to help you keep your money safe and under control. It offers security features, overdraft up to $200 fee-free, direct deposit, and a Visa debit card. Chime is trusted by millions of users, and it is not a bank but partners with The Bancorp Bank or Stride Bank, N.A. to provide banking services.

Features

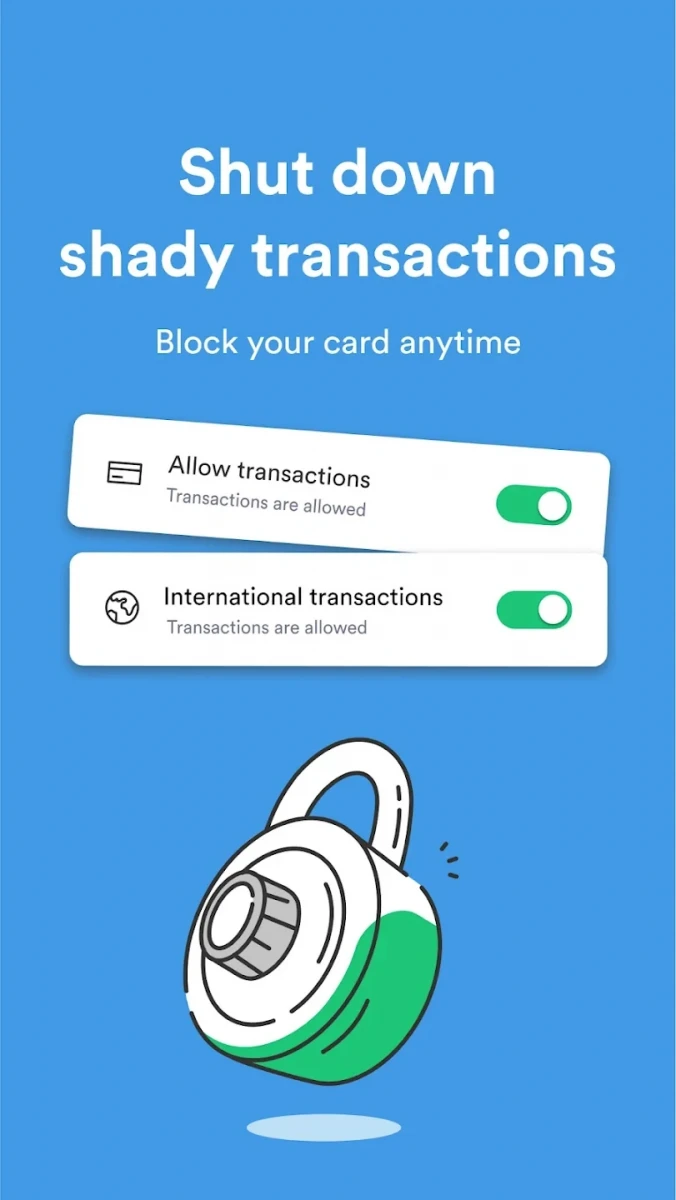

• Security features: Stay in control of your money with instant transaction and daily balance alerts. Enable two-factor authentication and block your card in a single tap.

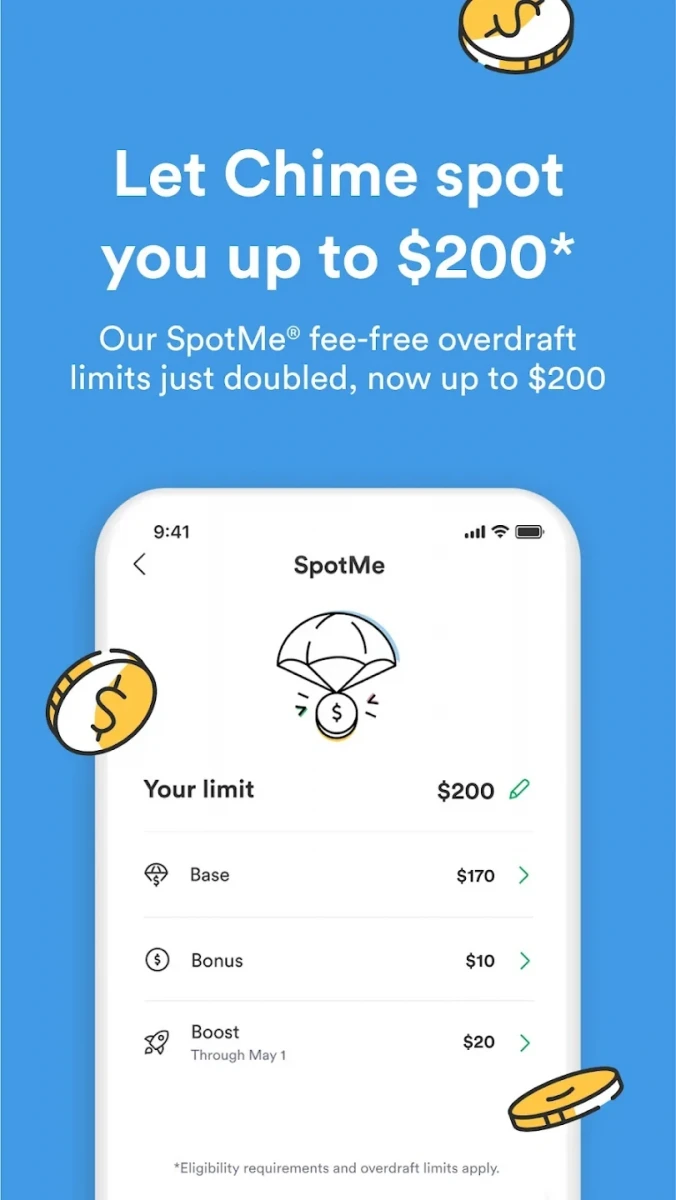

• Overdraft up to $200 fee-free: Eligible members on Chime can overdraft up to $200 on debit card purchases and ATM withdrawals fee-free.

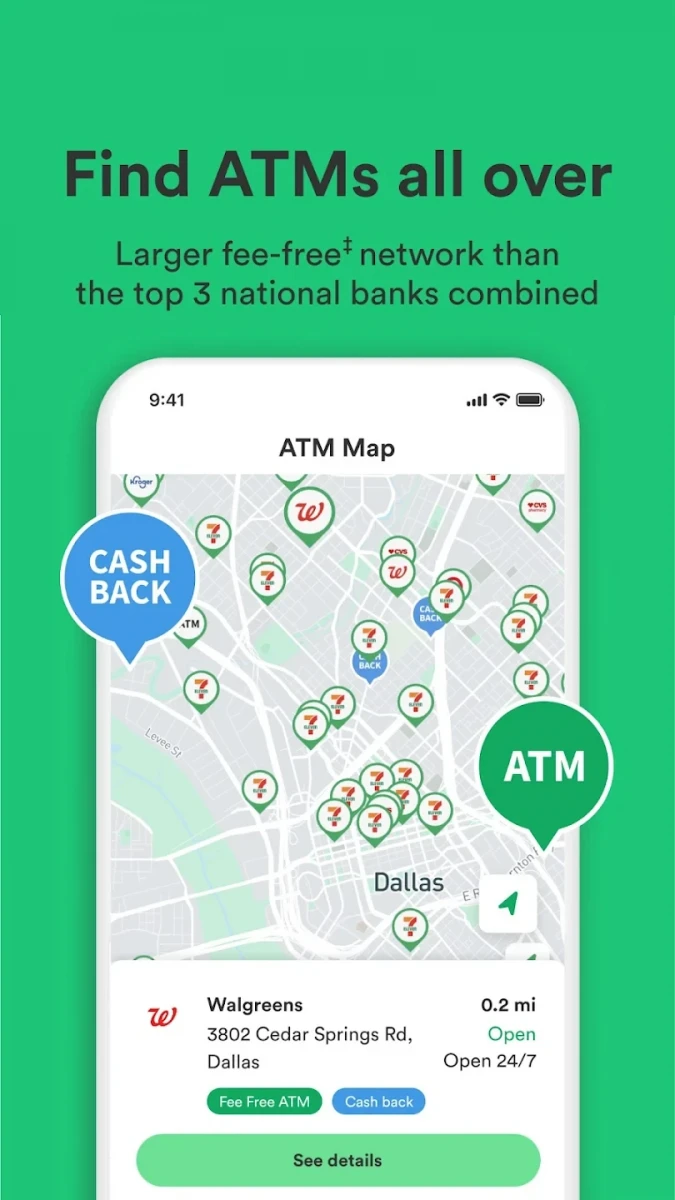

• No monthly fees: Chime has no monthly maintenance fees, minimum balance fees, or foreign transaction fees. Plus, access 60k+ fee-free ATMs.

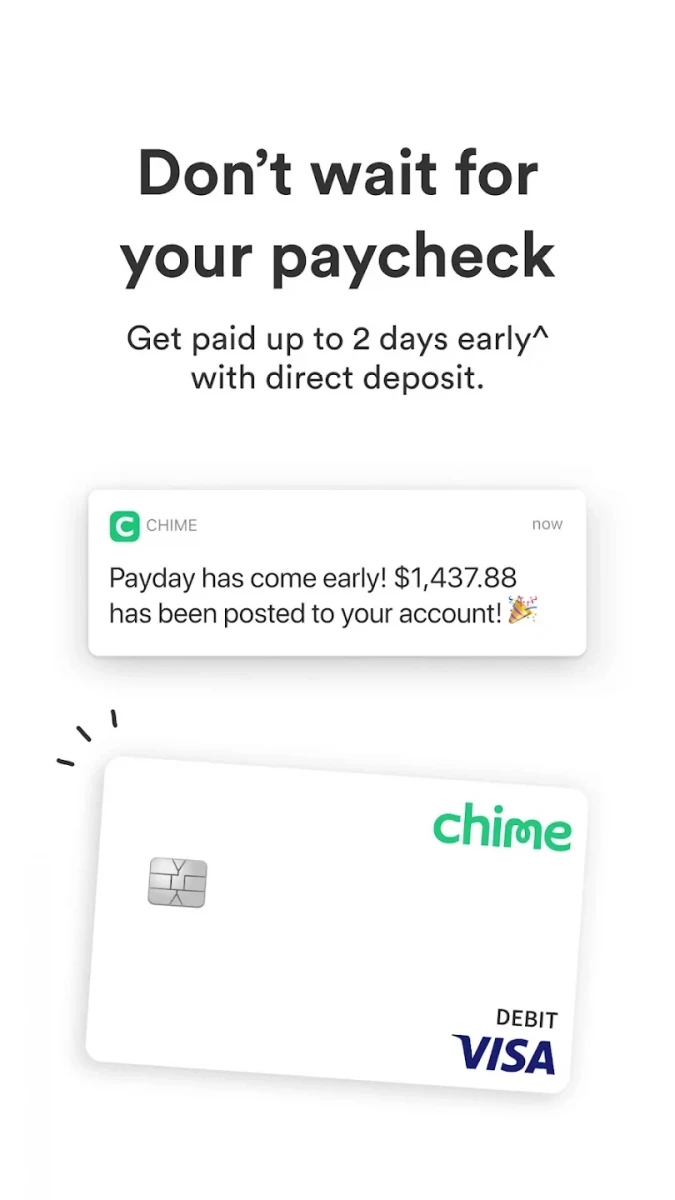

• Early direct deposit: Get paid up to two days early with direct deposit, earlier than you would with some traditional banks.

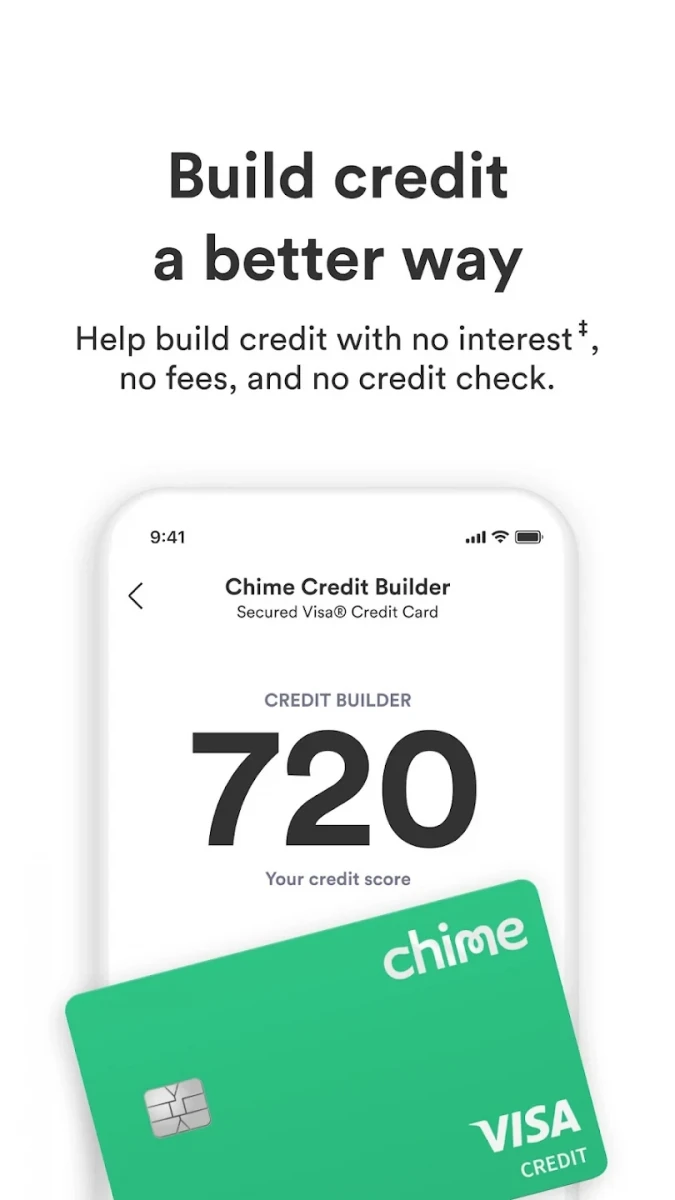

• Credit Builder: Use Credit Builder to increase your FICO® Score by an average of 30 points with regular on-time payments. No interest, no annual fees, no credit check to apply.

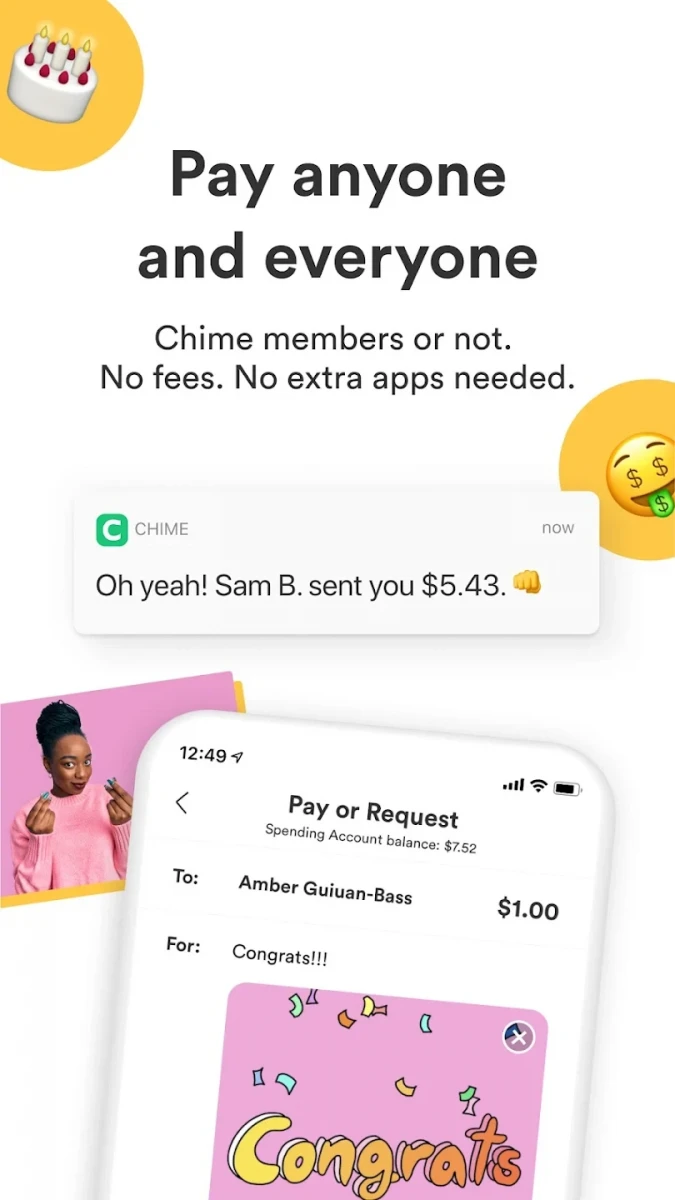

• Send money with no transfer fees: Send money to friends, family, or roommates as fast as a text with no transfer fees.

Usage Tips

• Set up transaction and balance alerts to keep track of your account activity.

• Take advantage of the fee-free overdraft feature if you need a little extra cash.

• Use the Chime Visa debit card for fee-free purchases and access to fee-free ATMs.

• Sign up for direct deposit to receive your paycheck up to two days early.

• Consider using Credit Builder to improve your credit score over time.

• Send money to others easily with Chime's no-fee transfer feature.